Adding Payers to the System

You can add payers to the system in two ways:

- Entering payer information on W-2 or 1099 forms

- Entering payer information directly into the Payer Manager

Using either method, the system saves any payer information in the Payer Manager. This information is then made available on W-2s and 1099s via the QuickEntry - Select Payer drop down list. See Using QuickEntry to Select Payers.

Adding Payers to the System from a Form

The default Enable Payer Manager setting in Open Return Preferences ensures that any payer information entered directly on a W-2 or 1099 form will be automatically saved to the Payer Manager repository. For subsequent W-2s and 1099s, the payer appears in the QuickEntry-Select Payer drop-down list.

Payer information is added when entered onto forms W-2, W-2G, 1099-G, 1099-R, 1099-S, 1099-DIV, 1099-INT, and 1099-MISC.

To add new payer information to a W-2 or 1099:

This instruction assumes that you've created a return with either a W-2 or 1099 input worksheet attached.

- From the open return, click either the W-2 or 1099 tab.

The input worksheet of the corresponding form appears.

You can enter payer information on either the Input or Detail worksheet, depending on your preference.

- Enter payer information on the form.

- To save the return, do one of the following:

- Click the Save button on the toolbar

- Click the Returns menu; then, select Save Return

To add payers directly to the Payer Manager:

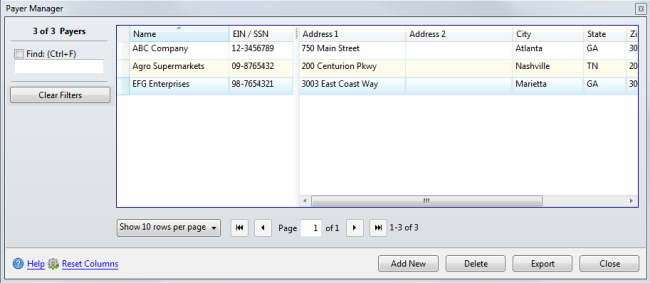

- From Return Manager, click the Tools menu; then, select Payer Manager.

Payer Manager

- Click Add New.

- Enter the payer’s information on the row provided.

- Click Close.